Relative strength index (RSI)

In June 1978, Welles Wilder’s article introduced the Relative Strength Index (RSI), which is a widespread oscillator. Mr. Wilder’s book, “New Concepts in Technical Trading Systems,” also provided step-by-step instructions on counting and explaining the RSI. The name “Relative Strength Index” is slightly deceptive, because there is no comparison of the relative strength of two securities in the RSI, but rather the single security’s domestic strength. “Internal Strength Index” might be a more suitable name. Relative strength scales compare two market indices, which are often known as Comparative Relative Strength.

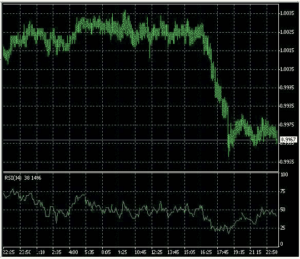

The RSI arranges between 0 and 100 and it is also named as a price-following oscillator. The best analysis of the RSI was found out: it is better to find a divergence in which a new high is being made by the security, but the RSI is going down to surpass its previous peak. This divergence means that soon the reversal will come. A “failure swing” completed, when the RSI turns down and decrease below its most recent low.

The fact that the failure swing happened proves the coming reversal. Mr. Wilder’s described in his book five uses of the RSI in analyzing commodity charts, which could be used as the other security types. Here are the five uses:

- Tops and Bottoms – Before the underlying price chart, the RSI surmounts above 70 and falls below 30 as usual.

- Chart Formations – Chart patterns, such as head and shoulders (page 215) or triangles (page 216) that could or could not be evident on the price chart, are often formed by the RSI.

- Failure Swings – These are sometimes called support or resistance penetrations or breakouts; the RSI exceeds a previous peak (high) at this moment or falls below a recent trough (low).

- Support and Resistance – Sometimes more clearly than price themselves, levels of support and resistance are demonstrated by the RSI.

- Divergences – As it was described earlier, divergences happen when the price goes lower (or higher) and it is not affirmed by a new high (or low) in the RSI. Prices usually reform and follow the RSI.

It would be good to read the Mr. Wilder’s book, where you could find additional information.

Calculation

The RSI Indicator is an indicator of speed of changing of price. It is calculated in the following way:

RSI = 100 / (1 + D(P,n)/U(P,n)),

Where U(P,n) is a moving average of growth of the P price within n periods,

D(P,n) – is a moving average of falling of the P price within n periods.

There are all possible merits of the indicators situated in an area from 0 to 100. The two control levels (the higher bottom control level is above 70, the lower bottom control level is below 30) are placed on the chart with the help of horizontal markers.

While the RSI increases and overcomes the top control level (above 70), the indicator displays the oversaturation of the market with buy trades, and then begins the zone of sales. Conversely, when the RSI crosses the low bottom control level (below 30), the indicator displays the oversaturation of the market with sell trades, and then starts the buying area.